Access to the right capital is essential for established businesses planning to scale operations, manage cash flow, or invest in long-term growth. In 2026, business financing has expanded well beyond traditional bank loans, offering more flexible and data-driven solutions for companies of all sizes.

With lenders increasingly relying on AI, cash flow analysis, and real-time financial data, established businesses now have access to a wider range of funding options. From small business loans to big company loans, understanding how each option works can help business owners secure capital faster and more efficiently.

This guide explains the best financing options for established businesses in 2026, when to use them, and how to choose the right solution based on business needs.

What Qualifies as an Established Business in 2026?

An established business typically meets the following criteria:

- At least 2+ years of operating history

- Consistent monthly or annual revenue

- Active business banking records

- Proven and stable cash flow

- Tax filings and financial statements

These factors allow established businesses to qualify for better terms on funding options such as medium business loans, big business loans, and long-term financing products.

Best Financing Options for Established Businesses in 2026

- Business Term Loans:

Business term loans remain one of the most widely used financing solutions for established companies.

Best for:

- Business expansion

- Equipment or technology purchases

- Large one-time investments

Key features:

- Fixed repayment schedule

- Predictable monthly payments

- Short-term or long-term options

Term loans are commonly used by medium-sized and big companies that need structured financing for planned growth.

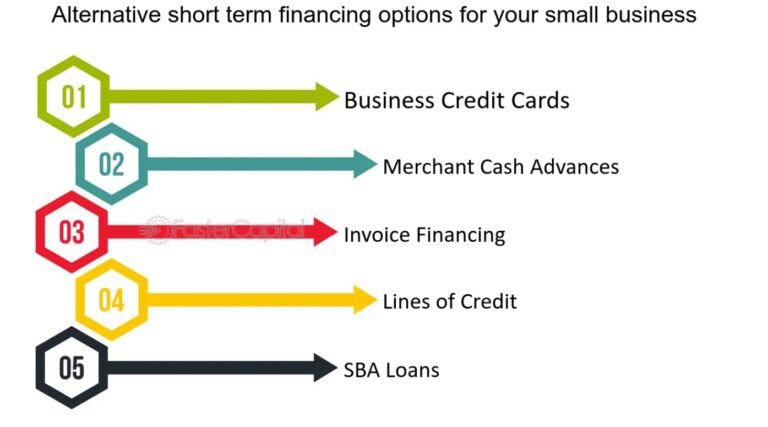

- Business Lines of Credit:

A business line of credit provides flexible access to funds, making it ideal for ongoing financial needs.

Best for:

- Seasonal expenses

- Inventory purchases

- Managing short-term cash gaps

Why businesses choose it:

- Borrow only what is needed

- Interest applies only to used funds

- Credit limit resets after repayment

This option is popular for established businesses that want flexibility without committing to a fixed loan amount.

- Revenue-Based Financing:

Revenue-based financing has become more common in 2026 due to its adaptable repayment structure.

How it works:

- Repayments adjust based on monthly revenue

- Higher revenue leads to higher payments

- Lower revenue results in smaller payments

Best for:

- Businesses with strong sales but uneven cash flow

- Companies avoiding fixed monthly obligations

This option is often compared with a merchant cash advance, though revenue-based financing typically offers more transparent terms.

- SBA Loans:

SBA loans remain a reliable option for established businesses with solid financial documentation.

Benefits:

- Lower interest rates

- Longer repayment terms

- Higher loan limits

Considerations:

- Longer approval timelines

- Detailed documentation required

SBA loans are best suited for long-term investments rather than urgent funding needs.

- Equipment Financing:

Equipment financing allows businesses to purchase or upgrade machinery without large upfront costs.

Best for:

- Manufacturing companies

- Construction businesses

- Medical and technical industries

The equipment often serves as collateral, making approval easier for established businesses with consistent revenue.

- Commercial Mortgage Financing:

For businesses investing in property, commercial mortgage financing remains an important option.

Best for:

- Purchasing office buildings or warehouses

- Expanding business-owned real estate

- Long-term property investments

Mortgage financing is commonly used by big businesses and big companies seeking asset-backed growth.

- AI-Based Business Financing Platforms:

In 2026, AI-powered financing platforms help established businesses find suitable funding faster and with fewer rejections.

Why businesses use AI funding solutions:

- Faster funding decisions

- Smarter lender matching

- Reduced reliance on credit scores

- Clearer eligibility insights

AI platforms analyze cash flow, revenue patterns, and business behavior to match companies with appropriate funding options, from small business loans to big company loans.

How to Choose the Right Financing Option:

When evaluating the best financing options for established businesses, consider:

- Purpose of the funding

- Repayment structure and flexibility

- Speed of funding required

- Cash flow consistency

- Long-term business goals

Choosing the right financing reduces financial risk and supports sustainable growth.

Common Mistakes Established Businesses Should Avoid:

- Applying to multiple lenders without preparation

- Overlooking cash flow health

- Using short-term funding for long-term needs

- Ignoring repayment terms and total cost

Proper planning significantly improves approval outcomes and financial stability.

FAQs – Best Financing Options for Established Businesses

- What is the best financing option for established businesses in 2026?

The best option depends on business goals. Term loans, lines of credit, and revenue-based financing are among the most common choices.

- Do established businesses need perfect credit to qualify?

No. Many lenders prioritize cash flow and revenue stability over credit scores.

- How fast can established businesses get funding in 2026?

AI-driven evaluations allow some funding options to be approved within days.

- Are SBA loans still relevant in 2026?

Yes. SBA loans remain valuable for long-term, lower-cost financing.

- Is revenue-based financing the same as a merchant cash advance?

They are similar but not identical. Revenue-based financing usually offers clearer terms and more predictable costs.

- Can AI help businesses find better financing options?

Yes. AI tools match businesses with lenders based on real financial data, improving approval chances.

Conclusion:

The best financing options for established businesses in 2026 provide more flexibility, faster approvals, and smarter matching than ever before. From small business loans to big business loans, today’s funding landscape offers solutions for companies at every stage of growth.

By understanding each option and preparing accurate financial data, established businesses can secure capital confidently and build long-term success.