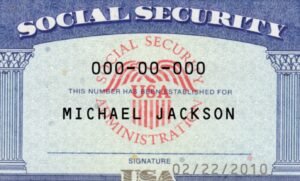

A Social Security Number is a unique set of nine-digit which the US government provides to all US citizens and some residents who apply for one. The number is used to track US citizens’ lifetime of income and how many times they worked. When it comes to retirement or if someone needs a disabled income, the government identifies all the information needed and examines the SSN to calculate his benefit payment if he is eligible for disability income.

Also, the SSN is very important for your whole life. It is now used for a wide range of purposes, including credit lending, receiving government benefits, opening a bank account and purchasing a home or car and more. However, most citizens are able to protect their social security number and use it their entire lives, although some people make a mistake and need a replacement number at some point due to identity theft.

Opening an Account with US Financial Institution

When you need to open an account with a financial institution, they ask your SSN to check your credit. Also, they use it to properly manage your account and report your interest and investment income or loss to the IRS. There may be a chance to provide them your identity in an alternative way. You can offer your taxpayer identification number, some institutions may ask for an Employer Identification Number.

Applying for a Federal Loan

It is needed most time to apply for your federal loan. The government will use it to identify if you are eligible to apply for a federal loan such as a federal student loan. You must have US citizenship or residency status and most male applicants are required to register with the selective service.

Applying for Disability Income

When it comes to applying for someones’ disability income, they must have a Social Security number. The US government agencies use this number to verify people’s eligibility to receive unemployment benefits or social security disability income from the government.

When Applying for a Passport

When you apply for a passport as a US citizen, you must ask for your social security number in accordance with federal law. , If you cannot show your SSN, your entire process may be delayed. You are being fined about $ 500 in addition to failing to deliver it.

On Your Tax Return

Another purpose of this is to apply for your tax return when you are thinking it’s right. Then, the IRS checks it on your tax return to match the income you reported as well as the income that your employer and financial firms reported to you for your tax payment. Also, you must provide your kid’s SSN to claim your child as a subordinate on your tax return.

To Get a Driver’s License

You must provide your SSN when you apply for a driver’s license. Non-citizens who do not have SSNs are usually identified for social security numbers in many situations, such as applying for a driver’s license, receiving private health insurance services, registering for a school, or government public assistance. Besides, the US government does not allow to provide the SSN to non-citizens who don’t have the authorization to work in the US. Even, bank and credit companies also usually say no if they don’t have one which they either lost or theft.

So, if you, unfortunately, lose your SSN, guess how you will suffer in your upcoming circumstances. All things on your income, probably including Social Security numbers. However, if you don’t have this number, the financial institutions also fail to check your credit which could make it hard to get a credit card or loan. So, you should protect your social security number if you don’t want to deprive your government facilities. For this purpose, you need a template file for regular use and then you will be free to worry about losing your original SSN card.